While having a mental illness can be debilitating it shouldn't be a deterrent to living a full and rich life. Travel can be a wonderful way to alleviate some of the symptoms of mental illness but what about that tiny issue of travel insurance? You want to be covered medically in the event of an emergency, so what exactly do you need to know?

Historically insurers were reluctant to provide cover to those with mental illnesses, however an increasing number of companies on the market are now offering varying degrees of cover. It may be tricky to find cover, but don't rule your options out just yet! After all pre-existing medical conditions can be tricky to navigate and a holiday may be well overdue!

Does Travel Insurance Cover Mental Illness?

When it comes to mental illness, cover will depend on a range of factors;

- Some companies will now offer cover by assessment for mental illnesses such as anxiety disorder, depression, schizophrenia, bipolar disorder and stress. Once these are assessed cover may be granted, which could cost you an additional premium.

- Some insurers will cover for mental illness if the traveller has not suffered and/or sought help for that condition in the previous five years.

Note that most travel insurers within the Australian market do still exclude cover for mental illness, however, a few listed in the table below will consider cover on a case-by-case basis.

So Who Covers What?

The following table highlights which insurers consider cover for mental illness by application and/or whether a first time mental illness episode would be covered.

Click the ticks and crosses for more details on each.

| Insurer | Underwriter | Mental Illness cover on application | First time mental illness episode covered | Buy Now |

|---|---|---|---|---|

HDI Global Specialty SE – Australia | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Certain underwriters at Lloyd's | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Mitsui Sumitomo Insurance Company Limited | What you are not covered for:

You, or any insured person on your policy, has, in the 5 years prior to the policy issue date, suffered from or received medical advice, treatment or medication for:any psychiatric or psychological condition (including anxiety or depression). | |||

HDI Global Specialty SE – Australia | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Mitsui Sumitomo Insurance Company Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. There is no cover for amendment or trip cancellation costs due to mental illness including anxiety, depression or stress, by you, a relative, or travelling companion, unless diagnosed by a registered psychiatrist as a new medical condition. | |||

HDI Global Specialty SE – Australia | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Mitsui Sumitomo Insurance Company Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Allianz Australia Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Allianz Australia Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Zurich Australian Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. There is no cover for amendment or trip cancellation costs due to mental illness including anxiety, depression or stress, by you, a relative, or travelling companion, unless diagnosed by a registered psychiatrist as a new medical condition. | |||

CGU Insurance Ltd | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Zurich Australian Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. There is no cover for amendment or trip cancellation costs due to mental illness including anxiety, depression or stress, by you, a relative, or travelling companion, unless diagnosed by a registered psychiatrist as a new medical condition. | |||

Zurich Australian Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. There is no cover for amendment or trip cancellation costs due to mental illness including anxiety, depression or stress, by you, a relative, or travelling companion, unless diagnosed by a registered psychiatrist as a new medical condition. | |||

Zurich Australian Insurance Limited | Existing Medical Conditions We automatically include:

Anxiety and Depression | |||

Certain underwriters at Lloyd's | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. There is no cover for amendment or trip cancellation costs due to mental illness including anxiety, depression or stress, by you, a relative, or travelling companion, unless diagnosed by a registered psychiatrist as a new medical condition. | |||

Chase Underwriting Pty Ltd | We are not liable for any claim arising out of or related to:

Anxiety, depression, mental illness or stress suffered by you, a relative or another person unless referred to and diagnosed by a registered psychiatrist or psychologist as a new condition. | |||

Zurich Australian Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. There is no cover for amendment or trip cancellation costs due to mental illness including anxiety, depression or stress, by you, a relative, or travelling companion, unless diagnosed by a registered psychiatrist as a new medical condition. | |||

Guild Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. | |||

Southern Cross Benefits Limited | We won't cover any claims, costs or losses or liabilities directly or indirectly arising from, related to or associated with the following:

Any pre-existing medical condition, whether it's diagnosed or undiagnosed. | |||

Pacific International Insurance Pty Ltd | no -We will not cover any of the following:

A loss arising from any existing medical condition of you, a member of the travelling party, a non-travelling close relative or business partner. This exclusion will not apply to your specified medical condition(s) or to your Automatically covered conditions. | |||

Certain Underwriters at Lloyds | We will not cover any of the following:

A loss arising from any existing medical condition of you, a member of the travelling party, a non-travelling close relative or business partner. This exclusion will not apply to your specified medical condition(s) or to your Automatically covered conditions. | |||

Chase Underwriting Solutions Pty Ltd | We are not liable for any claim arising out of or related to:

Anxiety, depression, mental Illness or stress suffered by You, a Relative or another person or referred to and diagnosed by a registered psychiatrist or psychologist as a new condition. | |||

Zurich Australian Insurance Limited | Claims which in any way relate to, or are exacerbated by, an Existing Medical Condition or related new infections are specifically excluded from this policy unless Your Existing Medical Condition is approved by Us. | |||

Pacific International Insurance Pty Ltd | We will not cover any of the following:

A loss arising from any existing medical condition of you, a member of the travelling party, a non-travelling close relative or business partner. This exclusion will not apply to your specified medical condition(s) or to your Automatically covered conditions. | |||

Tokio Marine & Nichido Fire Insurance Co. Ltd | no - We will not cover any claim arising from or related to the following:

Any medical condition related to or associated with any Pre-Existing Medical Conditions, except as provided for under the section "Pre-Existing Medical Conditions". | |||

Allianz Australia Insurance Limited | No general exclusions listed for mental illness. You must disclose your condition and depending on your answers the insurer will decide whether to cover and what premiums may apply. |

General Advice Warning: The contents of this article were accurate at the time of writing. Insurers change their policies from time to time, so some information may have changed. You should always read the Product Disclosure Statement of your chosen insurer to understand what is covered and what isn't. The information provided is of a general nature only and does not take into account any personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal circumstances.

I Can't Find Cover For My Mental Illness! What Are My Options?

In the event that your are not able to obtain cover for your particular mental illness you should be aware that medical cover is just one of the many benefits of travel insurance. There are plenty of additional circumstances in which travel insurance could prove to be very handy! Just remember that you may not be covered for any claims related to, exacerbated by, or arising from your particular pre-existing medical condition without prior approval.

Other Reasons To Buy Travel Insurance

Although your health is top priority there are other big factors that can make travel insurance an essential for all travellers!

- Lost or stolen luggage: When you’re dealing with illness, the last thing you need is the extra financial stress of a lost suitcase or stolen wallet. Travel insurance will cover you for any lost, stolen or damaged items, provided you look after them.

- Cancellations and emergencies: Should your flight be delayed for more than 24 hours, your travel insurance provider will cover any costs you’ve accrued. You’ll also be covered should you miss a flight due to any type of motor vehicle accident or natural disaster. It's best to buy travel insurance as soon as you book your holiday - that way if you have to cancel your trip for any unforeseen circumstance you'll be covered.

- Rental car excess: Planning a bucket list road trip? Your policy will usually cover rental car excess, so you can drive off into the sunset, worry free.

- Personal liability: Your policy will cover you in the event that you are responsible for another person’s injury. Most comprehensive policies will cover you for up to $2 million in personal liability fees.

Tips For Travelling With A Mental Illness:

Having a pre-existing condition shouldn't curb your thirst for travel, but it's sensible to be prepared should your condition flare up.....here's a few tips for safe and healthy travelling when you have a mental illness.

- Consult with your doctor and make sure you have all the medication you require for your trip. It's a good idea to have a doctor's note to accompany your medications in case you are queried at customs.

- Do your research and talk to your medical team about your destination and the solution to common travel issues like jet lag and motion sickness. Knowing what to expect and how to treat various unpleasant symptoms can relieve symptoms of anxiety and keep you in control.

- Be prepared for the possibility of homesickness. Travel can be exhilarating but difficult at times for those prone to feelings of loneliness and isolation.

- Bring along some coping strategies. Whether it's some helpful print outs, meditation exercises or some deep breathing techniques, make sure you have some tried and tested coping aids for those stressful moments.

- Practise moderation when on the road. It can be easy to go overboard while travelling and overindulge in poor food choices, alcohol and too little sleep. Ensure you are maintaining some healthy habits and taking care of your mind and body.

- Sort out your paperwork. A letter from your doctor stating your pre-existing condition, symptoms you suffer from and a list of emergency contacts can be helpful should you require medical assistance during your travels. Relevant information that is easily accessible to a foreign medical practitioner can get you on the road to recovery, fast.

What’s Next?

Remember to always check the fine print before you purchase a policy. Don’t simply assume that you’re automatically covered by travel insurance.

Phew! Feeling informed? Once again, it's important to remember that having a mental illness shouldn’t deter you from taking that long-awaited holiday!! Once you’ve compared travel insurance policies, spoken to your insurance provider and taken all the necessary precautions for your trip there’s nothing left to do but focus on enjoying your trip. And have fun!

*Please note: the contents of this article were accurate at the time of writing. Insurers change their policies from time to time, so some information may have changed. You should always read the product disclosure statement of your chosen insurer to understand what is covered and what isn't.

mental illness travel insurance faqs

Some travel insurers don't offer any coverage for pre-existing conditions including mental health issues. Other travel insurance brands require you to complete a medical assessment online to figure out whether they can cover you. Don't worry - it's easier than it sounds. You simply answer some questions about your condition. Medical screening forms may ask about recent hospitalisations, whether you take any medication, whether you are currently seeing a psychiatrist or psychologist, and if you have ever cancelled travel due to a mental illness before. Find out who covers pregnancy and learn more on the conditions of cover for each travel insurer using our table above.

Specialist medical travel insurer AllClear Travel Insurance offers medical travel insurance for mental health conditions, including more severe cases of anxiety, depression, bipolar disorder and schizophrenia. While they do not cover all travellers with all conditions, they may be worth considering if a standard travel insurer won't cover you.

Otherwise, you can look into an insurance broker, or insurers who do not cover pre-existing conditions. The latter would, however, mean that you had no coverage if a deterioration of your existing mental health condition was the reason you had to cancel or curtail your trip, or seek medical attention overseas.

Speak to your doctor about having a plan for what do should a panic attack strike. Having a plan and tools can reduce the fear of panicking, and reduce likelihood of panic attacks.

If the person is on your policy, make sure you or they fill out a medical assessment - otherwise, if they have to cancel the trip due to their illness, neither of you would be covered.

If the person you're travelling with has a mental health condition and they are with a different insurer, your insurer is unlikely to cover you for someone else's pre-existing condition.

If you have forgotten to declare your mental health conditions to your insurer, give them a call to see if they can update your pre-existing medical assessment. Otherwise, you wouldn't be covered for any issues related to your pre-existing condition.

This is dependent on you and your circumstances. If, as a result of your pre-existing mental health conditions you needed to pay for medical expenses overseas, or had lost deposits from cancellation or curtailment of your trip, you would generally not have provision to claim.

Eugene Wylde

Eugene is the king of insurance! Having spent more than ten years raising awareness on the importance of holiday protection, he is a self-confessed insurance geek extraordinaire when it comes to the world of travel cover. Eugene loves helping people save time, worry and loads of money with the right policy at the right price. His ideal holiday is any one where he has a pina colada in his hand. Salut!

trending tips and guides

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Pregnancy Travel Insurance Guide

Not all insurers will cover you automatically if you’re over 22 weeks gestation or have had pregnancy complications. See which companies offer cover for pregnant women.

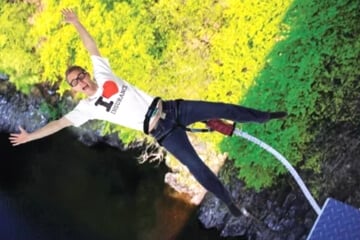

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

1Cover

1Cover Fast Cover

Fast Cover InsureandGo

InsureandGo Ski-Insurance

Ski-Insurance Tick Insurance

Tick Insurance Zoom Travel Insurance

Zoom Travel Insurance AllClear

AllClear Australian Seniors

Australian Seniors Boomers

Boomers Budget Direct

Budget Direct Bupa Australia

Bupa Australia Cover-More

Cover-More Easy Travel Insurance

Easy Travel Insurance Freely

Freely Go insurance

Go insurance Insure4Less

Insure4Less Medibank Private

Medibank Private Passport Card

Passport Card SCTI

SCTI Travel Insurance Direct

Travel Insurance Direct Travel Insurance Saver

Travel Insurance Saver Travel Insuranz

Travel Insuranz Webjet

Webjet World Nomads

World Nomads World2Cover

World2Cover Worldcare

Worldcare