Whether you’re planning to gallivant across the globe or you’re looking to explore your own country, the joy of travel is the new experiences it brings.

We know that relaxing on a beach or sitting poolside at a five-star resort sipping cocktails is not everyone’s idea of a fun-filled holiday. If you’re someone who likes to push boundaries and get your heart racing, it's important to have travel insurance coverage that's right for your trip. For the more adventurous among us, when it comes to buying travel insurance, it is important to think about our planned activities and understand what is and isn’t covered.

For many Aussies, holidays aren’t complete without a few thrills and spills. It's important to know that not all adventure activities are covered as standard within a typical policy. Finding yourself injured and unprotected after an accident overseas could easily send your adventure belly-up! So before you go thrill-seeking on your travels, let our handy adventure guide help you narrow your search and avoid unnecessary holiday hurdles.

Who covers what adventure sports?

Most travel insurers have a long list of sports & activities that are automatically covered, but what is included in one policy, may be specifically excluded from the next. For this reason, travellers who plan to partake in specific sports or activities should check for exclusions. In many cases, if an activity isn't covered, you can opt to purchase an adventure pack or winter sports add-on.

Please note: An additional premium or adventure pack may be required in order to be sufficiently covered. Click on the rows to see more detail.

| Insurer | Underwriter | Quad biking | Scuba diving | Jet skiing | Animal conservation | White water rafting | Rock climbing | Sky diving | Cycling | Contact sports | Buy Now |

|---|---|---|---|---|---|---|---|---|---|---|---|

HDI Global Specialty SE – Australia | Must hold an open water diving licence recognised in Australia or you were diving under licensed instruction. | Hand tools only. | Rapids graded 1,2,3 only. | ||||||||

Certain underwriters at Lloyd's | Single rider only, no jumping, racing or competition | covered up to 30m depth must be qualified or if diving under licensed instruction. | Under appropriate supervision. | Rapids graded 1,2,3, only. | only with a licensed commercial operator and ropes and appropriate

safety gear but not free solo climbing | You must be in

tandem with a licensed instructor. | |||||

Mitsui Sumitomo Insurance Company Limited | Covered up to a depth of 30m, must be qualified and not diving alone or diving under licenced instruction. | Graded 1, 2, 3 & 4 only | Indoor and harnessed only | ||||||||

Mitsui Sumitomo Insurance Company Limited | Covered up to a depth of 30m, must be qualified and not diving alone or diving under licenced instruction. | Rapids 1,2,3, only. | Indoor and harnessed only | ||||||||

HDI Global Specialty SE – Australia | Must hold an open water diving licence recognised in Australia or you were diving under licensed instruction. | Hand tools only. | Rapids graded 1,2,3 only. | ||||||||

Mitsui Sumitomo Insurance Company Limited | Covered up to a depth of 30m | Rapids graded 1,2,3 only. | |||||||||

Chubb Insurance Australia Limited | Covered up to a depth of 30m, must be qualified and not diving alone or diving under licenced instruction. | Outdoor (with ropes and/or guides, or bolted) less than

3,000 metres above sea level | |||||||||

Allianz Australia Insurance Limited | Must be under direct supervision of a properly licenced organisation, obey all safety codes and wear protective gloves and helmet. | Covered up to a depth of 30m, must be qualified or diving under licenced instruction. | Rapids graded 1,2,3 only. | With ropes and safety gear. | |||||||

Allianz Australia Insurance

Limited | Must be under direct supervision of a properly licenced organisation, obey all safety codes and wear protective gloves and helmet. | Covered up to a depth of 30m, must be qualified or diving under licenced instruction. | Rapids graded 1,2,3 only. | With ropes and safety gear. | |||||||

Zurich Australian Insurance Limited | Organised day

tour | Covered up to 30m depth must hold an open water diving licence recognised in Australia or you were diving under licensed instruction. | Rapids graded 1,2,3, only. | Outdoor (with ropes and/or guides, or bolted) less than

2,000 metres above sea level | |||||||

Zurich Australian Insurance Limited | Organised day

tour | Must have appropriate licence for country diving in or you are diving under licensed instruction. | Rapids graded 1,2,3, only. | Outdoor (with ropes and/or guides, or bolted) less than

2,000 metres above sea level | |||||||

Zurich Australian Insurance Limited | Must hold an open water diving licence or you were diving under licensed instruction | Rapids graded 1,2,3, only. | Outdoor (with ropes and/or guides, or bolted) less than

2,000 metres above sea level | ||||||||

Certain underwriters at

LLoyd's | Covered up to a depth of 30m, must be qualified and not diving alone or diving under licenced instruction. | White or black rapids Graded 1, 2 & 3 only with a licenced operator | |||||||||

Chase Underwriting Pty Ltd | Must be provided by a licensed commercial operator- No cover in the USA or Canada. | Covered up to a depth of 10m, must be qualified and not diving alone or diving under licenced instruction | Must be provided by a licensed commercial operator- No cover in the USA or Canada. | Graded 1, 2, 3 & 4 only | Must be tandem and provided by a licensed commercial operator- No cover in the USA or Canada. | ||||||

Zurich Australian Insurance Limited | Must hold an open water diving licence or you were diving under licensed instruction | Rapids graded 1,2,3 only. | |||||||||

Southern Cross Benefits Limited | Must be diving under licenced instruction. | ||||||||||

Pacific International Insurance | Must be diving under licenced instruction. | ||||||||||

Certain Underwriters at Lloyds | Up to 10m depth | Excluding USA and Canada | Up to and including Grade 4 | Tandem | Amature only | ||||||

Chase Underwriting Solutions Pty Ltd | Must be provided by a licensed commercial operator- No cover in the USA or Canada. | Covered up to a depth of 10m, must be qualified and not diving alone or diving under licenced instruction | Must be provided by a licensed commercial operator- No cover in the USA or Canada. | Graded 1, 2, 3 & 4 only | Must be tandem and provided by a licensed commercial operator- No cover in the USA or Canada. | ||||||

Zurich Australian Insurance Limited | Covered up to a depth of 30m, must be qualified and not diving alone or diving under licenced instruction. | Under appropriate supervision. | In rapids Graded 1, 2, 3 | Outdoor (with ropes and/or guides, or bolted) less than

2,000 metres above sea level | |||||||

Pacific International Insurance Pty Ltd | 16 years old and over You must be with a professional, qualified and licensed guide or operator. | Covered up to a depth of 30m, must be qualified and not diving alone or diving under licenced instruction. | You must be with a professional, qualified and licensed guide or operator. | Under appropriate supervision. | In rapids Graded 1, 2, 3 | You must be with a professional, qualified and licensed guide or operator. | One jump only. | ||||

Allianz Australia Insurance Limited | Covered up to a depth of 30m, must be qualified or diving under licenced instruction. | Rapids graded 1,2,3 only. | With ropes and safety gear. |

General Advice Warning: The contents of this article were accurate at the time of writing. Insurers change their policies from time to time, so some information may have changed. You should always read the Product Disclosure Statement of your chosen insurer to understand what is covered and what isn't. The information provided is of a general nature only and does not take into account any personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal circumstances.

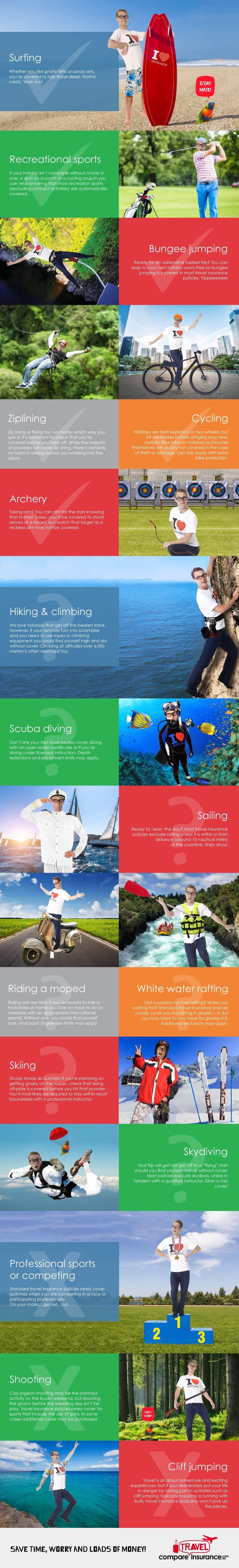

General Activities covered by travel insurance

-

Recreational sports: If your holiday isn’t complete without a hole in one, a spot on a yacht or a cycling sojourn, you can relax knowing that most recreation sports (excluding contact activities) are automatically covered. A standard travel insurance policy will usually include cover for camping, dancing, fishing, horse riding, ice skating, kayaking, swimming, surfing, trekking, and recreational sports such as football, netball and hockey.

-

Water activities: Popular with travellers to island and beach destinations. Most insurers will cover you for amateur water sports such as jet skiing, kayaking, paragliding, surfing, white water rafting and windsurfing but there are some slightly more extreme activities that require further explanation and some limitations apply.

-

Bungee jumping: Ready for an adrenaline-fuelled trip? You can leap to your next holiday worry-free as bungee jumping is covered in most travel insurance policies. Yippeeeeee!

Adventure activities that are sometimes covered

Higher risk adventure activities such as paragliding and sky diving can be covered, but limitations will usually apply. Some high-risk activities are automatically covered in some cases you’ll be able to pay an additional premium to get coverage and then there are certain activities that can't be covered.

-

Abseiling and rock climbing: We love holidays that get off the beaten track. However, if your rambles turn into scrambles and you need to use ropes or climbing equipment you could find yourself high and dry without cover. Most insurers do not cover mountaineering or rock climbing if you have to use ropes or any other mountaineering equipment. Climbing at altitudes over 6,000 metres is often restricted too. Insure4Less offers a rock-climbing policy (read more about hiking, trekking and altitude limits).

-

Archery: Taking aim? You can aim for the stars knowing that in most cases, you’d be covered to shoot arrows at a target, but watch that target as a reckless aim may not be covered.

-

Cycling: Holidays can be best explored on carbon-neutral two wheels but you should hit the brakes before bringing your new, carbon fibre bike on holidays. Bicycles themselves are usually not covered in the case of theft or damage. Get ride ready with extra bike protection.

-

Heli-skiing: You won’t find many insurers that cover heli-skiing within a standard policy but InsureandGo covers it in their winter sports policy and Ski-insurance.com.au covers it for an additional premium. Fly me to the Snow!

-

Sailing: Cover for sailing and boating varies a lot between providers, so if you’re planning to set sail on your holiday, make sure you understand your policy. Most travel insurance policies sold in Australia exclude sailing unless it is within a short distance of the coastline. For example; Southern Cross travel insurance excludes “ocean yachting 12 nautical miles or more from populated land" or in "any area with limited or no telecommunications or medical services", so you may not be covered even if you stayed close to land. Policies underwritten by Allianz excluded "open water sailing more than 10 nautical miles off any landmass". So dig deep on this one, look for the exclusions. There seems to be a growing demand for policies to cover sailing in international waters and amateur competitive sailing. Dinghy sailing and dragon boating are usually covered. Go Insurance offer a sailing extension that can be tailored to include offshore boating, recreational sailing, open water racing and regattas which includes cover for equipment, replacement crew members, boat charter excess waivers and more.

-

Snowboarding and Skiing: This is covered by most insurers in Australia provided you have purchased an insurance policy that includes ski/snow cover. However, if you’re planning on racing down the slopes acting recklessly, doing stunts, or skiing off-piste then you might find yourself without cover. InsureandGo covers for off-piste skiing with a professional snow instructor or guide.

-

Skydiving: If you insist on jumping out of a perfectly fine plane; fear not, there is cover available. Tandem skydiving or parachuting is commonly covered by travel insurers, but not by all. There aren't many providers that will cover you for skydiving if you’re planning to jump alone. Fast Cover, Insure4Less and Zoom Travel Insurance all cover tandem skydives. Cover-more, Nib, and Travel Insurance Saver will cover you for a solo jump (skydiving and parachuting, but not BASE or cliff jumping).

-

Scuba diving: Scuba diving is a popular activity for holiday goers so most insurers offer cover but have added in some restrictions to reduce their risk. Experienced divers with an open water diving certificate are generally covered but depth restrictions may be in place. Scuba to more info here.

-

Riding a motorbike: Many insurers will cover you for no additional charge for a bike up to 125cc. However, if you’re riding a motorcycle with an engine capacity of more than 200cc, without a helmet, or without a valid licence for the country you are operating in, you won’t be covered. Some insurers will charge extra for riding a scooter or moped. See our overseas motorbike riding guide for more information.

-

Ziplining: Ziplining or flying fox, no matter which way you spin it, it’s important to check that you’re covered before you take off. While the majority of providers will cover zip lining, there’s certainly no harm in asking before you whiz into the abyss.

Risky business no travel insurer covers

Increased adrenaline usually means increased risk and there are some activities that insurers simply will not cover.

-

Base or Cliff Jumping: Travel is all about adventure and exciting experiences, but if you deliberately put your life in danger by taking part in high-risk activities such as cliff jumping or balcony hopping, travel insurance probably won’t pick up the pieces. BASE jumping is significantly more hazardous than other forms of parachuting and is widely considered to be one of the most dangerous extreme sports.

-

Professional Sports: Standard travel insurance policies rarely cover activities when you are competing in a race or participating professionally. On your marks…get set…no!

-

Motorsport and Racing: Motoring is one of those activities that doesn’t tend to be coved by any insurers. If you’re planning on renting a sports car on holiday you’ll probably have insurance with the company you’re renting from – but always check before you hit the road.

-

Running with the Bulls: Running with the bulls in Spain is what it says on the tin. It’s a festival where 12 bulls are let loose in the streets of Pamplona Spain and you have to run in front of them! It’s very dangerous and every year, between 200 and 300 people are injured during the run. For this reason, it’s too risky for travel insurers to cover. So before you submit your claim for being bucked by a bull in Pamplona, or plan to ‘run with the bulls’, know that you’re not covered if you get injured.

-

Shooting: Clay pigeon shooting may be the planned activity on the bucks weekend, but shooting the groom before the wedding day isn’t fair play. Travel insurance policies rarely cover sports that include the use of guns. In some cases, additional cover may be purchased.

-

Expeditions to inaccessible, remote or previously unexplored places Planning a Bear Grylls style adventure? If you're hankering to be a first-ever pioneer of some yet unexplored territory or zone, you may have to dig very deep to find an insurer that will cover you. As far we know, there are no listed travel insurers that will cover you for expeditions to inaccessible areas.

Remember that what each policy does and does not cover varies between insurers so it is important to read the policy document before purchasing or contact your insurer directly if you’re unsure. If you had a sport or activity planned that didn’t get a mention, it may have slipped under our radar or it may not be covered. Be sure to contact your insurer to check if your planned activities are covered. If you can't find cover with your travel insurer, there may be a specialist sports insurer that offers cover.

While it is always good practice to shop around and compare travel insurance policies, your priority should be making sure you are fully covered for your planned adventure activities rather than just snapping up the cheapest quote.

Eugene Models Adventure Activity Cover

adventure travel insurance faqs

Travelling requires bravery and smarts in equal parts. We answer some of the most common questions from adventurous travellers to help you protect yourself as best you can.

Yes, some high-risk sports and activities are covered by travel insurance, but this is limited to what your insurer considers to be extreme and not insane. Find out which extreme activities are covered in a typical insurance policy.; Skiing, snowboarding, skydiving and downhill mountain biking are extreme sports you can easily find cover for. But if you plan to get your adrenaline-pumping thrills from base jumping, bullfighting, motor racing or ski acrobatics, you'll be out of luck. You will need to seek professional sports insurance and not travel insurance.

We believe that every traveller needs travel insurance. Life is unpredictable and anything can happen to anyone at any time. No matter what your appetite for adrenalin is, or how experienced you are in your chosen activity, travel insurance can help if something goes wrong. Typically, extreme sports operate in a unique environment far from hospitals and medical facilities and are characterized by high speeds and high risk. We think it pays to pack peace of mind. While an adrenaline rush can last up to an hour, overseas hospital bills can last a lifetime.

Adventure sports travel insurance provides access to 24 hour Emergency Assistance; it includes cover for overseas emergency medical and hospital expenses; and would provide cover for the cost of an ambulance or medical transport required to get you to the nearest hospital. Putting injuries aside, policies will usually also cover you for a host of other travel benefits such as cancellation or disruption if you need to cancel your trip or are delayed due to unforeseen events like a family emergency, illness or bad weather. There is also cover for lost or damaged luggage. Visit our comprehensive travel insurance guide to learn more.

Many travel insurers automatically cover you to ride a motorbike overseas, provided that you're wearing a helmet and have the correct licence and engine class according to their policy terms. Learn more from our guide on insurers that cover riding motorcycles, scooters and mopeds.

With its increased popularity for holidaymakers you can easily find an insurer that will cover for this but there will be certain restrictions. For example, most insurers will have maximum depth limits and you must hold a valid diving certificate or be diving with a qualified instructor. Check out our scuba diving cover guide.

Trekking is covered the majority of the time, but be advised that there may be some restrictions like altitude limits and if you require the use of ropes. Climbing insurance might be a bit harder to find as most insurers are unable to cover outdoor climbing and only a select few cover for indoor climbing with the use of a harness. Always check with your insurer when arranging the policy to find out if they cover for this and if they have certain restrictions. For further details on this have a look at our climbing and trekking guide.

Most insurers cover you medically if you were to have an accident on the slopes, but only if it’s recreational, on-piste and within the resort boundaries. If you are wanting a higher standard of ski insurance to cover ski passes, equipment hire then a ski-specific policy is advised. See our winters sports guide.

Travel insurers generally do not cover competitive events that involve you racing against time or other competitors, particularly if it involves winning prize money, or reward and recognition. On the other hand, if you are participating in an activity as an amateur, then depending on the type of activity, you may be able to obtain cover. You should contact your insurer directly if you're in doubt.

Eugene Wylde

Eugene is the king of insurance! Having spent more than ten years raising awareness on the importance of holiday protection, he is a self-confessed insurance geek extraordinaire when it comes to the world of travel cover. Eugene loves helping people save time, worry and loads of money with the right policy at the right price. His ideal holiday is any one where he has a pina colada in his hand. Salut!

1Cover

1Cover Fast Cover

Fast Cover InsureandGo

InsureandGo Tick Insurance

Tick Insurance Zoom Travel Insurance

Zoom Travel Insurance AllClear

AllClear Amex

Amex Australian Seniors

Australian Seniors Boomers

Boomers Budget Direct

Budget Direct Cover-More

Cover-More Easy Travel Insurance

Easy Travel Insurance Freely

Freely Go insurance

Go insurance Medibank Private

Medibank Private SCTI

SCTI Travel Insurance Direct

Travel Insurance Direct Travel Insurance Saver

Travel Insurance Saver Travel Insuranz

Travel Insuranz Webjet

Webjet World Nomads

World Nomads Worldcare

Worldcare