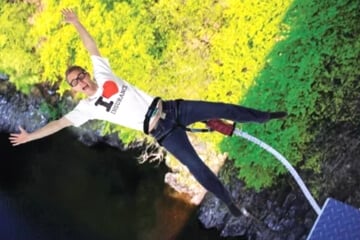

Every year without fail I am astounded to hear that an Australian has fallen off a moped after colliding with an elephant in Thailand. Actually, that hasn’t happened to my knowledge but an Australian will be involved in a scooter accident overseas twice a week!

This isn’t what astounds me. The fact that some do not have travel insurance, a motorbike licence and/or were not wearing a helmet does.

If you ask for a crash helmet whilst hiring your moped in Thailand you are likely to be greeted with a chuckle followed immediately by a “are you being serious” frown. If you’re lucky, you may get given a cardboard box with eye holes. Instead of backing out of the hire shop, hiring a tuk-tuk for 50 cents or walking to your desired destination, most tourists will shrug, climb on board the rickety wreck with a slightly flat tyre, and speed off. Death or disaster will not greet me today, it is sunny and I am on holiday!

Wait for a second though, before speeding off… I must apply sunscreen and put on my baseball cap. I wouldn’t want to get sunburnt. Most of us have succumbed to the “slip slop slap” ads to prevent skin cancer and we apply sunscreen at home, and overseas. It is strange, therefore, that the thought of cracking our heads open following a 70km an hour somersault, isn’t a problem.

Anyone who has owned a scooter or motorbike in Australia will have spent hundreds of dollars on safety gear, knowing the dangers of coming off. Oh, and they will also have had to pass a learner bike riding course before hitting the road and subsequently obtain their riders licence and have bought bike insurance.

We would all stop and stare, slightly perplexed, if we saw someone riding down the highway in a t-shirt, shorts, thongs and… no helmet in Australia, Curiously, when we go overseas a lot of us lose all concept of risk. We are indestructible. Roads are statistically more dangerous in Thailand and Bali yet we are happy to “see what happens”.

So, will travel insurance cover me?

Sometimes. If you haven't worn a helmet, or do not have a current Australian motorcycle licence (or one valid for the country you are travelling in), allowing you to drive the same cc powered bike, then you have a problem! Please don’t get angry with your travel insurer when they don’t pay your rather large hospital bill if you haven't followed these common-sense rules. No travel insurance provider on planet earth is obliged to cover you for such events.

The same goes if you’re a passenger travelling on a motorcycle, moped, scooter or any other two-wheeled ride that is in the control of a person who does not hold a current motorcycle licence valid for the country you're in.

Eugene Wylde, Insurance Geek Extraordinaire from Comparetravelinsurance.com.au explains:

“Travel insurance policies exist to cover you for unforeseen events, not situations where risk is rife. To quote the insurers themselves…You will not be covered if you do not act in a responsible way to protect yourself or your property to avoid making a claim.”

"If you’re not insured to ride a Harley in Australia, what makes you think you can do so overseas!? Travel insurance policies have different terms and exclusions, so it's important to pay attention to the detail, particularly when it comes to licences and the maximum engine sizes you’re permitted to ride."

Most insurers do not require you to have a licence if riding a low capacity engine less than 50cc, but let's face it, I'm not sure these lawnmowers still exist. Some insurers have maximum engine size limits that you’re only insured to ride - irrespective of what your licence says. And then some cover you for whatever engine size you ride as long as you’re insured to do so in Australia.

So, don't assume you can just jump on a bike and go. Check out our guide on travel Insurance while riding a motorcycle or scooter overseas.

The hard facts say it all

Every year, many Australian tourists are involved in motorbike accidents overseas which result in serious injuries and tragically, even deaths.

“There are at least 100 travel insurance claims a year relating to moped and bike accidents abroad. That’s two a week!” as claimed by Eugene Wylde, a spokesperson from Comparetravelinsurance.com.au.

According to Smartraveller, motorcycle accidents involving Australians are very common in South-East Asia, particularly in areas such as the busy streets of Bali, resort areas of Thailand and the yet to be paved roads of Vietnam.

“The most common reasons for illness or hospitalisation amongst young people who travel to Bali are injuries due to motorbike accidents and nightclub fights," a DFAT spokesman said.

“Young adults are particularly vulnerable. Traffic accidents are the leading cause of death among young people between 10 and 24 years. Each year nearly 400,000 people under 25 die on the world’s roads; on average more than 1000 a day. Most of these deaths occur among vulnerable road users (pedestrians, cyclists, motorcyclists) and those using public transport.” According to the Global Status Report on Road Safety: time for action, World Health Organisation.

Protect your Wheels

It’s important to know that most travel insurance policies only provide cover for medical claims when it comes to motorbike accidents. There is no cover for the motorbike itself or its accessories.

One for the pros

Standard travel insurance policies do not cover competitive sports. So if you’re heading overseas to compete in a motorcycle race, look elsewhere for specialist cover.

Riding a motorcycle or scooter on holiday can be a thrilling, inexpensive way to travel...until something happens! The cost of a hospital trip overseas can send your budget skyrocketing and your stress levels too. Make sure you ride safe and have adequate cover before you hit the road.

Safe travels now,

Eugene Wylde Insurance Geek Extraordinaire

Who covers Mopeds or Scooters?

You can compare the various moped/scooter engine limits here. Click on the plus icon for more information.

| Insurer | Underwriter | Maximum engine size | Buy Now |

|---|---|---|---|

|

|

HDI Global Specialty SE – Australia

|

No limit

|

|

|

|

Certain underwriters at Lloyd's

|

No limit (with premium added)

|

|

|

|

Mitsui Sumitomo Insurance Company Limited

|

No limit

|

|

|

|

Mitsui Sumitomo Insurance Company Limited

|

No limit

|

|

|

|

HDI Global Specialty SE – Australia

|

No limit

|

|

|

|

HDI Global Specialty SE – Australia

|

No limit.%% For riding a motorcycle, you must have a current Australian motorcycle licence and a motorcycle licence valid for the country you are riding in. For riding a moped/scooter, you must have a current Australian drivers licence and a drivers licence valid for the country you are riding in. You must be wearing a helmet.

|

|

|

|

Allianz Australia Insurance

|

No limit (with premium added)

|

|

|

|

Chubb Insurance Australia Limited

|

200cc

|

|

|

|

Zurich Australian Insurance Limited

|

200cc

|

|

|

|

Allianz Australia Insurance Limited

|

No limit (with premium added)

|

|

|

|

Allianz Australia Insurance

Limited

|

No limit (with premium added)

|

|

|

|

Zurich Australian Insurance Limited

|

No limit

|

|

|

|

Allianz Australia Insurance Limited

|

No limit

|

|

|

|

Zurich Australian Insurance Limited

|

250cc

|

|

|

|

Zurich Australian Insurance Limited

|

No limit.%% You must pay an additional

premium. Cover starts from the time the additional premium is paid.

There are two levels of cover:

• Motorcycle/Moped Riding • Motorcycle/Moped Riding +

|

|

|

|

Zurich Australian Insurance Limited

|

250 cc.%% pay the additional premium for

Motorcycle or Moped Riding

|

|

|

|

Certain underwriters at

LLoyd's

|

250cc

|

|

|

|

Chase Underwriting

|

No limit

|

|

|

|

AIG Australia Limited

|

No Limit

|

|

|

|

Zurich Australian Insurance Limited

|

200cc (with premium added)

|

|

|

|

Southern Cross

|

200cc

|

|

|

|

Pacific International Insurance

|

No limit

|

|

|

|

Certain Underwriters at Lloyds

|

For mopeds 125cc, For motorcycles 1200cc

|

|

|

|

Chase Underwriting

|

No limit

|

|

|

|

Zurich Australian Insurance Limited

|

No limit (with Adventure Pack)

|

|

|

|

nib Travel Services (Australia) Pty Ltd

|

No limit%%

|

|

|

|

Pacific International Insurance

|

No limit (with sports adventure pack)

|

|

|

|

Allianz Australia Insurance

Limited

|

250cc

|

|

General Advice Warning: The contents of this article were accurate at the time of writing. Insurers change their policies from time to time, so some information may have changed. You should always read the Product Disclosure Statement of your chosen insurer to understand what is covered and what isn't. The information provided is of a general nature only and does not take into account any personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal circumstances.()

Eugene Wylde

Eugene is the king of insurance! Having spent more than ten years raising awareness on the importance of holiday protection, he is a self-confessed insurance geek extraordinaire when it comes to the world of travel cover. Eugene loves helping people save time, worry and loads of money with the right policy at the right price. His ideal holiday is any one where he has a pina colada in his hand. Salut!

trending tips and guides

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Pregnancy Travel Insurance Guide

Not all insurers will cover you automatically if you’re over 22 weeks gestation or have had pregnancy complications. See which companies offer cover for pregnant women.

1Cover

1Cover Fast Cover

Fast Cover InsureandGo

InsureandGo Tick Insurance

Tick Insurance Zoom Travel Insurance

Zoom Travel Insurance Allianz

Allianz Amex

Amex Australia Post

Australia Post Australian Seniors

Australian Seniors Boomers

Boomers Budget Direct

Budget Direct Bupa Australia

Bupa Australia Cover-More

Cover-More Easy Travel Insurance

Easy Travel Insurance Freely

Freely Go insurance

Go insurance Insure4Less

Insure4Less Jetstar

Jetstar Medibank Private

Medibank Private SCTI

SCTI Travel Insurance Direct

Travel Insurance Direct Travel Insurance Saver

Travel Insurance Saver Travel Insuranz

Travel Insuranz Webjet

Webjet Woolworths

Woolworths World Nomads

World Nomads Worldcare

Worldcare