The common misconception is that all cancellations, delays, or missed travel situations are covered by travel insurance, but this is not the case. We help explain the misunderstandings around travel insurance and cancellation cover, so that you can head on holiday knowing when you're covered.

What is Cancellation cover?

If you have a comprehensive travel insurance policy, it includes cancellation cover. Cancellation cover varies across insurers, but it generally means the lost deposits and cancellation fees for pre-paid holiday arrangements due to unforeseen circumstances, which are not expected, intended, or within your control.

Different sections of your travel insurance policy relate to different times and parts of your trip. Generally, anything that happens before travelling falls under ‘Cancellation’ and anything that happens once you have already started your journey will generally fall under ‘Alternative Transport Expenses’, ‘Travel Delay Expenses’ or 'Disruption of Journey'. But they are all different remedies to unforeseen circumstances which might affect your trip.

Compare Cancellation Coverage

It depends on which policy you choose. Most insurers offer different cover levels and often at very different price points. We've compared the cheapest comprehensive-style policy offered by each insurer to give you a rough idea. To compare coverage and prices for your trip, use our quote function above.

| Insurer | Underwriter | Policy Name | Cancellation | Buy Now |

|---|---|---|---|---|

HDI Global Specialty SE – Australia | Comprehensive | Unlimited | ||

Certain underwriters at Lloyd's | Comprehensive | Unlimited | ||

Mitsui Sumitomo Insurance Company Limited | Insure & Go Gold | Unlimited | ||

HDI Global Specialty SE – Australia | Comprehensive Cover | Unlimited | ||

Mitsui Sumitomo Insurance Company Limited | Top | $20,000 | ||

HDI Global Specialty SE – Australia | Comprehensive | Unlimited | ||

Mitsui Sumitomo Insurance Company Limited | Gold Plus Cover | Unlimited | ||

Chubb Insurance Australia Limited | International Comprehensive | $10,000 | ||

Allianz Australia Insurance Limited | Comprehensive Cover | Unlimited | ||

Allianz Australia Insurance Limited | Comprehensive Cover | Unlimited | ||

Zurich Australian Insurance Limited | Comprehensive | $10,000 | ||

Zurich Australian Insurance Limited | Premium | Unlimited | ||

Zurich Australian Insurance Limited | Comprehensive Cover | Unlimited | ||

Zurich Australian Insurance Limited | Overseas Explorer | $5,000 | ||

Certain underwriters at Lloyd's | GO Elite | $25,000 | ||

Chase Underwriting Pty Ltd | Excel Plus | $10,000 | ||

Guild Insurance Limited | Comprehensive | Unlimited | ||

Southern Cross Benefits Limited | Comprehensive | $2,500 | ||

Pacific International Insurance Pty Ltd | The Works Plan | Unlimited | ||

Certain Underwriters at Lloyds | Comprehensive | $20,000 | ||

Chase Underwriting Solutions Pty Ltd | Deluxe | $10,000 | ||

Zurich Australian Insurance Limited | Comprehensive | Unlimited | ||

Pacific International Insurance Pty Ltd | Explorer | Unlimited | ||

Tokio Marine & Nichido Fire Insurance Co. Ltd | Top Cover | Unlimited | ||

Allianz Australia Insurance Limited | Comprehensive | Unlimited |

What are "unforeseen circumstances"?

...and when are you covered for travel delays, alternative transport and cancellation?

Provided that you purchased your policy before you became aware of the circumstances (or they were published in the media), commonly covered scenarios include:

Bad weather or natural disasters

If your flight or cruise is cancelled due to severe weather or a natural disaster, such as a volcanic eruption, tornado, or bushfire, you may be able to claim for transport, accommodation and other pre-paid expenses. Most insurers also offer cancellation cover if your home in Australia is affected by a natural disaster, and you need to defend it or if it is rendered uninhabitable by a flood, fire, or explosion.

Sickness or injury

If you become injured or ill and become unfit to travel, or if you have to return home if a medical practitioner notifies the insurer that you are unfit to continue with your trip. You will need this in writing and it generally cannot be from an undeclared pre-existing medical condition.

Sickness or injury of a family member

If you need to return home or cancel a trip because a family member is unwell or there has been a death of a close family member. This is subject to limitations - most insurers do not cover if the relative is over 80-85, if they were hospitalised due to a pre-existing medical condition, or the relative resides outside Australia or New Zealand. Check out our guide on family emergencies for more.

Strikes, civil unrest or riots

If a strike, civil unrest or riot directly affects your flights or accommodation. If the unrest or rioting hasn't directly affected your travel arrangements, cancelling your trip may be considered by your insurer as a 'change of mind' scenario, which is generally not claimable.

Accident en route

If you missed your flight/booked transport because of a motor vehicle accident, railway accident or marine accident en route and you can prove that there was no other way for you to get to your transport carrier. You will generally need a letter from an authority, such as the police or transport provider to prove the accident happened.

Theft of passports, travel documents or credit cards

If your passport or documents are stolen, travel insurance will reimburse you for your expenses incurred when replacing your items, as well as cancellation fees or lost deposits if you are unable to continue your journey due to theft of your passport.

Getting to special events

If your flight or other transport has been cancelled or delayed, and you need to reach a special event, such as a sporting event, wedding, or funeral, many insurers cover your alternative transport expenses to get there on time - even if the reason your flight or transport was cancelled was the airline's fault. Different insurers consider different things a 'special event', so check that your policy does what you need it to.

Delays or disruption of journey

If you experience a flight delay (typically of more than six hours), and your airline doesn't look after you, your travel cover can provide accommodation and food benefits of around $200-$250 per adult for each day the disruption occurs. If you miss a connecting flight due to the first airline's fault, some insurers also cover the cost of getting you on a new flight - provided that you've left at least 3-5 hours for connections. Check your insurer's policy documents to see if they offer this, or give them a call.

Cancellation of annual leave - if you're in the emergency services

Many insurers cover full-time defence force, police and other emergency service personnel coverage if their annual leave is revoked. Again, each insurer is different on this, so be sure to check your policy works for your circumstances.

Cancellations that are not covered

Of course, not every situation can be covered and this is when the confusion starts.

Cancellations where the airline is responsible

If your flight was cancelled due to a mechanical fault, overbooking, maintenance, repairs, rescheduling, service faults, a pilot sleeping in, or the airline closing down then you are generally covered. It is the airline’s responsibility to compensate, reimburse, or find an alternative flight for the traveller – not the insurer.

The exception is where insurers offer alternative transport expenses or disruption of journey benefits, which help you get to a special event, like a wedding, or cover meals and accommodation, regardless of whether the airline was at fault.

Missing flights where you're responsible

Slept in? Turned up to check-in too late? Delays caused by your negligence are not covered under travel insurance. Insurers will ask that you left ‘sufficient’ time to get to the airport. This includes missed connecting flights.

Cancellations due to undeclared pre-existing conditions

If you cancel because of a pre-existing condition that you didn't declare, or a family emergency where the cause is a pre-existing condition.

Change of mind

If you decide you don't want to go on holiday anymore, travel cover won't cover you.

Cancellation of annual leave

Unless you're in the defence force, police, or other emergency services, you're generally not covered if your employer revokes your annual leave.

Visa refusals or not having the appropriate documents

If your destination visa is denied and you've already paid for flights and accommodation, travel insurance cannot help, as it’s up to the traveller to verify that their visa requirements have been met. Likewise, if you are turned away from the foreign country because you weren't aware of a visa requirement, most insurers consider this to be a general exclusion.

In some cases, the airline might refund your tickets as they're not allowed to fly passengers to a country without a visa.

Exams

If you or another member of your group is suddenly required to sit an exam and cannot travel then most travel insurance will not cover your travel costs.

Underbooked tour

If your tour is cancelled due to underbooking, this is generally not a covered situation. A travel insurance policy is a legal document and yet so many travellers chose not to read the Product Disclosure Statement which explains in detail all the policy benefits. Each insurer has a list of inclusions and exclusions, to avoid any doubt, check this before you travel.

Insolvency of a travel provider

If your travel agent, tour provider or airline becomes insolvent, very few insurers cover this. Check out our guide to learn more about who covers different travel company insolvency situations.

Claiming for travel cancellations

Claiming for trip cancellations doesn't have to be difficult. Check your insurer's product disclosure statement, and read through the sections on cancellations, alternative transport expenses, travel delays, etc, as well as the general exclusions so you're aware of what you can and can't claim for. Find your insurer's claims web page, fill out the form and upload your documents. You'll generally need copies of your itineraries, refund advice, proof of payments and proof of the reason for your trip cancellation - this will vary depending on the reason you need to cancel your holiday.

Visit our guide more on claiming for travel cancellations and delays.

trip cancellation faqs

Your trip cover may cover work-related issues, depending on your circumstances. If you are a full-time employee and are made redundant, you may have provision to claim with some insurers. Additionally, if you are a full-time employee of the defence forces or emergency services and your annual leave is revoked, many insurers will cover you for cancelling your trip. Checking for benefits like this can help in the long run.

Comprehensive travel insurance includes cancellation benefits for accommodation, flights, and other pre-paid deposits if you need to cancel your trip due to illness, injury, natural disasters, family emergencies, and other unforeseen circumstances.

Yes, provided that you were unaware of the natural disaster, and it hadn't been published in the mass media, you may have provision to claim for a cancellation due to natural disaster. However, some insurers have natural disaster add-ons which aren't automatically included. Other insurers only cover for natural disasters occurring within Australia - so check your policy before you buy.

Yes, provided you didn't know about the strike or rioting beforehand, it would generally be covered with most insurers. You would have to demonstrate that the strike or riot directly affected you though - so get a letter from your airline or accommodation or tour provider as evidence.

Very few insurers offer cancellation coverage for terrorism or acts of war - this is often a general exclusion, or they will only cover medical expenses if you are injured. Check your policy documents before you buy to confirm what coverage is available.

No, there are no insurers that we are aware of which cover if you cancel your trip and change of mind.

While you might think of your pets as a member of the family - we certainly think of ours that way - but most insurers do not cover you to cancel your trip if your furry buddies become ill. However, some insurers will cover your pets for veterinary treatment.

Crystal Moran

With a research and journalism background, and certified in Tier 2 General Insurance General Advice, Crystal is passionate about investigating customers’ tricky travel questions and helping them find the answers they’re looking for. A writer and filmmaker whose favourite trips have been to film festivals in Cuba and South Korea, and campervanning around the USA, she loves getting to know new people and seeing a glimpse of the world through their eyes.

trending tips and guides

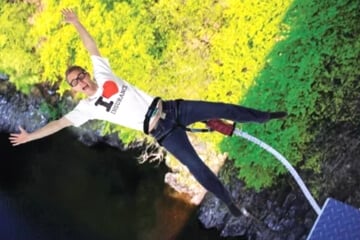

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Trip Cancellation And Natural Disasters

Are you covered to cancel your trip in the event of a natural disaster? The answer will depend on your choice of insurer.

1Cover

1Cover Fast Cover

Fast Cover InsureandGo

InsureandGo Ski-Insurance

Ski-Insurance Tick Insurance

Tick Insurance Zoom Travel Insurance

Zoom Travel Insurance AllClear

AllClear Amex

Amex Australian Seniors

Australian Seniors Boomers

Boomers Budget Direct

Budget Direct Cover-More

Cover-More Easy Travel Insurance

Easy Travel Insurance Freely

Freely Go insurance

Go insurance Insure4Less

Insure4Less Passport Card

Passport Card SCTI

SCTI Travel Insurance Direct

Travel Insurance Direct Travel Insurance Saver

Travel Insurance Saver Travel Insuranz

Travel Insuranz Webjet

Webjet World Nomads

World Nomads World2Cover

World2Cover Worldcare

Worldcare